Tuesday, July 4, 2023

Got Stocks top1 stock - The Trade Desk

Wednesday, June 21, 2023

Got Stocks performance

Holdings and Average Performance:

wikifolio Got Stocks currently boasts an impressive portfolio consisting of 21 carefully selected holdings. One notable factor that sets Got Stocks apart is its consistent average performance of +2.1% per year.

Recent Performance:

In the past 3 months, wikifolio Got Stocks has witnessed a substantial surge, with an impressive performance of +20.6%.

Top Performers:

Within Got Stocks' portfolio, there are three standout investments that have significantly contributed to its success. Topping the list is Nvidia, a renowned technology company, which has yielded a remarkable profit of +143.2%. Another noteworthy inclusion is The Trade Desk, a leading global advertising technology company, which has provided a substantial profit of +39.3%. Additionally, HubSpot, a leading provider of inbound marketing and sales software, has contributed a commendable profit of +35.0%. These top-performing holdings demonstrate Got Stocks' ability to identify companies with great growth potential.

Profitable Transactions:

wikifolio Got Stocks has also made some profitable transactions by selling certain stocks at opportune moments. Tesla was sold with a significant profit of +31.2%. Another profitable transaction involved Airbnb stocks, which were sold with a profit of +9.8%.

Conclusion:

By making timely and profitable transactions, Got Stocks has proven its ability to navigate the market and maximize returns. Investors seeking a transparent and successful portfolio management strategy can find inspiration in wikifolio Got Stocks.

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. Investors are encouraged to conduct their own research and consult with a qualified financial advisor before making any investment decisions.

Wednesday, June 14, 2023

Got Stocks Performance

Tuesday, June 13, 2023

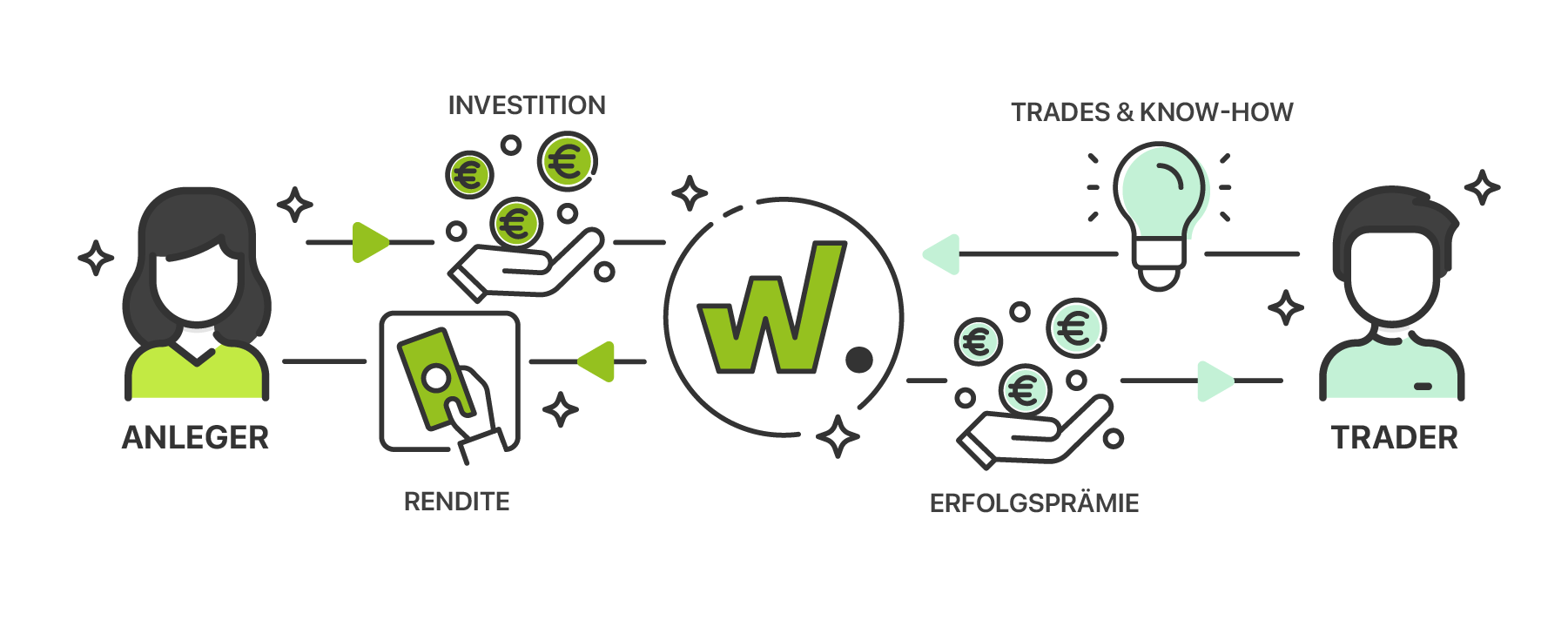

Unveiling the Wikifolio: Revolutionizing Investment Strategies

In the vast and dynamic world of finance, investors are constantly on the lookout for innovative platforms that can offer them unique opportunities and insights. One such platform that has gained significant attention in recent years is Wikifolio. Combining the concepts of social trading, transparency, and collaborative investing, Wikifolio has emerged as a revolutionary force in the investment landscape. In this blog post, we will dive deep into the world of Wikifolio, exploring its features, benefits, and the impact it has had on the investment community.

Understanding Wikifolio:

At its core, Wikifolio is an online platform that allows users to create, share, and invest in investment portfolios called "wikifolios." These portfolios are created by private traders, known as "wikifolio traders," who execute trades using their own funds. The performance of these wikifolios is publicly displayed, providing complete transparency to investors.

The Power of Social Trading:

Wikifolio stands out from traditional investment platforms by embracing the concept of social trading. It enables users to follow and invest in the strategies of successful wikifolio traders, leveraging their expertise and experience. This social aspect creates a collaborative environment where investors can learn from each other and benefit from diverse investment strategies.

Transparency and Trust:

Transparency is a key pillar of Wikifolio's philosophy. Each wikifolio trader's performance is publicly available, allowing potential investors to assess their track record and investment style. This level of transparency builds trust within the community and provides a valuable benchmark for making informed investment decisions.

Diversification Opportunities:

One of the major advantages of Wikifolio is the abundance of investment options. The platform covers a wide range of asset classes, including stocks, bonds, commodities, and cryptocurrencies. This diversity offers investors the ability to create well-rounded portfolios and reduce risk through asset allocation strategies.

Accessibility and Ease of Use:

Wikifolio's user-friendly interface makes it accessible to both experienced and novice investors. Creating an account, browsing through wikifolios, and investing in them is a straightforward process. Additionally, the platform provides detailed information about each wikifolio, such as trading history, risk indicators, and performance metrics, facilitating informed decision-making.

Participating as a Trader:

Wikifolio not only caters to investors but also empowers traders to showcase their skills and build a following. By becoming a wikifolio trader, individuals can monetize their investment strategies and earn success fees based on the performance of their wikifolios. This aspect has attracted a diverse community of traders, fostering innovation and the exchange of ideas.

Risk Management and Investor Protection:

Wikifolio places a strong emphasis on risk management and investor protection. Before a wikifolio can be invested in, it must pass a strict eligibility process, which includes a review of the trader's qualifications and the performance history of the wikifolio. Additionally, the platform offers features such as stop-loss orders and risk management tools to help users mitigate potential losses.

Conclusion:

Wikifolio has truly revolutionized the investment landscape by combining social trading, transparency, and collaboration. Its platform empowers both investors and traders, providing them with a unique opportunity to learn, share, and benefit from each other's expertise. By embracing this innovative approach, Wikifolio has created a vibrant community that thrives on collaboration, trust, and informed decision-making. Whether you are a seasoned investor or just starting out, Wikifolio offers a compelling platform to explore new investment opportunities and participate in the exciting world of social trading.

Got Stocks top1 stock - The Trade Desk

Performance since position open (03.02.2023): +42.4% The Trade Desk is a global technology company that operates a self-service platform for...

-

Performance since position open (03.02.2023): +42.4% The Trade Desk is a global technology company that operates a self-service platform for...

-

In the ever-evolving world of investments, finding the right opportunities can be a daunting task. However, there are platforms like wikifo...

-

In the vast and dynamic world of finance, investors are constantly on the lookout for innovative platforms that can offer them unique oppor...